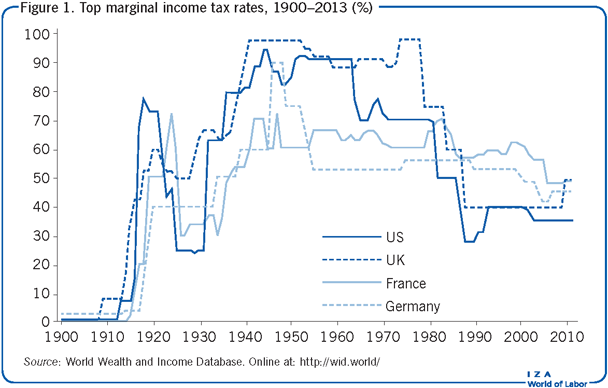

ian bremmer on X: "A little history on top marginal tax rates in the US, UK, France & Germany.. https://t.co/4GgqUiJH7u" / X

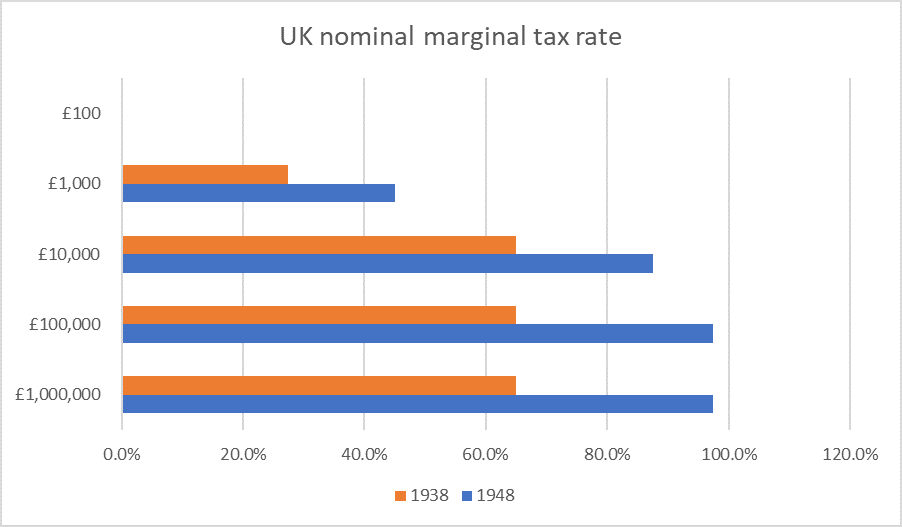

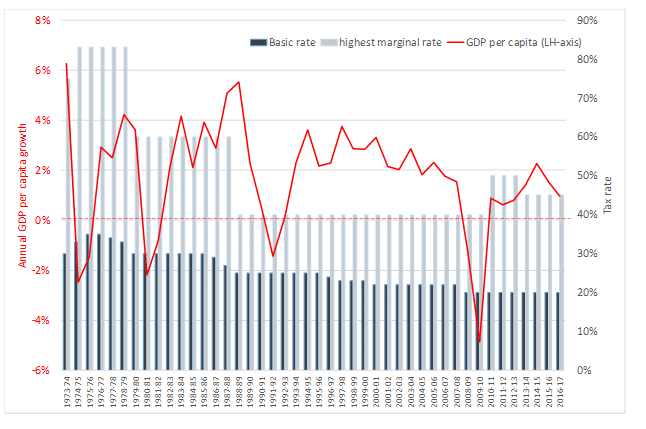

Adam Tooze on X: "In the early 1960s the US had the highest top marginal income tax rate of the large capitalist democracies. Since WWII it had vied with the UK for

![Top Marginal Income, Corporate Tax Rates: 1916-2010 [CHART] | HuffPost Impact Top Marginal Income, Corporate Tax Rates: 1916-2010 [CHART] | HuffPost Impact](https://i.huffpost.com/gen/267149/MARGINAL-TAX-RATES.jpg)